Banking & Payments

GBA hype in reopened Hong Kong hides tougher reality

DigFin suggests how to help banks and fintechs turn the Greater-Bay-Area slogan into real business.

Published

1 year agoon

By

admin

Now that Hong Kong’s border with mainland China is open, its senior officials are loudly proclaiming the city ready for business as part of the new Greater Bay Area.

For instance, on January 18 in Davos, Hong Kong financial secretary Paul Chan told the World Economic Forum that the GBA will combine the financial might of New York with the tech prowess of San Francisco.

Yet, while many in the city’s financial sector are excited by the prospect of mainland customers flowing back to Hong Kong, they are scratching their heads as to what opportunities the GBA will deliver.

The vision

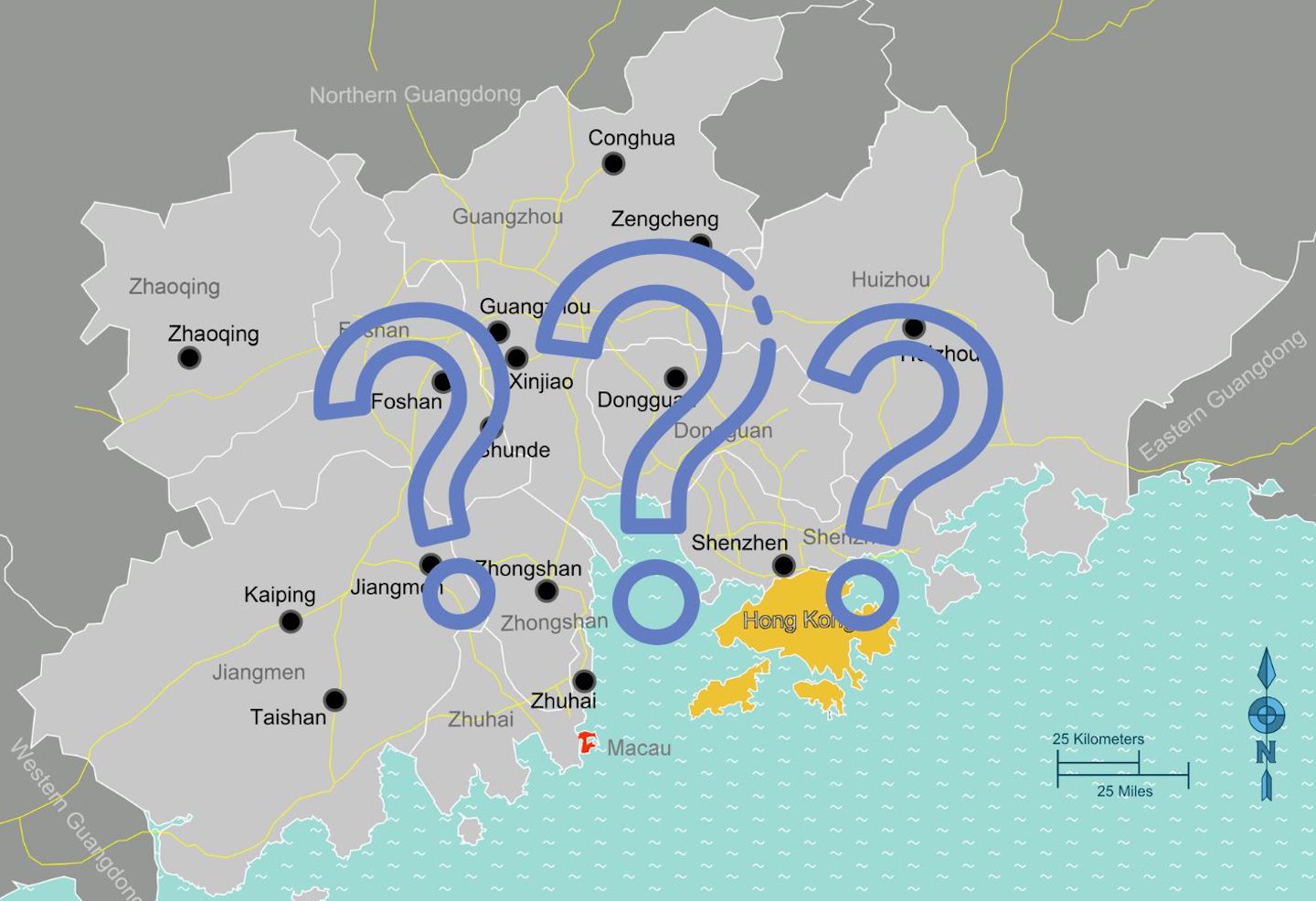

The GBA is a political idea proposed by China’s President Xi Jinping in 2017 to integrate Hong Kong and Macau with nine cities in neighboring Guangdong Province, including the tech and advanced-manufacturing powerhouse of Shenzhen.

Sales pitches like Chan’s point to the GBA’s combined population of 87 million people (young and wealthy by Chinese standards), and a gross domestic product of $1.9 trillion.

The reopening of the border between Hong Kong and the mainland, after a three-year closure, naturally creates a sense of that promise coming good.

Bain, a consultancy, released a paper on January 9 outlining the opportunity for banks to serve Guangdong’s 2.5 million microenterprises, 270,000 small-sized enterprises, and 27,000 medium-sized enterprises. These SMEs, many of which plug into global supply chains, are hungry for cross-border financial services, Bain argues, so cue the GBA.

No action

The problem is that Secretary Chan could have given the same speech in 2017; in fact, he has given the same speech many times, and the recitations of the GBA vision are de rigueur at any tech or finance conference in Hong Kong. But industry players say the barriers remain too high to make the GBA a business reality.

“Many in the bank are eager to brainstorm new ideas now that the border is open,” says the head of innovation at a traditional bank in Hong Kong. “But while the border has been closed for three years, there have been no policy changes for doing cross-border business. Marketing, exchanging data, financial regulation, account opening, other restrictions…nothing has changed.”

There are three things that SMEs in mainland China want from a Hong Kong bank or a fintech with money-transfer and lending licenses: remote account opening, a line of credit, and cross-border payments.

The payments aspect has been possible for many years; the rules and procedures are well known, and banks and fintechs can provide inbound and outbound remittances and foreign exchange.

The other two are not possible for SMEs or individual customers that are based in Guangdong (or anywhere in mainland China).

Account opening and lending

Opening bank accounts requires someone to be in Hong Kong, and if it’s for an SME, they need to argue why they need it. That is easy for businesses with existing Hong Kong operations. But SMEs that don’t have a Hong Kong operation but want international financial services won’t be able to open an account, remotely or in person. That would require them to provide the Hong Kong bank with their credit history or other details from the mainland. Doing so might breach mainland laws on data and cybersecurity.

- Read more:

- Livi now live-testing its virtual banking app

- UBS wealth management goes mid-market in China

- For insurers, outlook for GBA fintech is hazy

That restriction goes for extending credit too, even if it’s done digitally. Even the same bank with branches on both sides of the border cannot share this data internally, so they can’t make a credit assessment.

Lending is further complicated by the need to accept customer collateral. Even if a bank has branches on both sides, the Guangdong branch can’t accept collateral for a loan being extended by the Hong Kong branch. What’s a Hong Kong bank going to do with someone’s factory (or other asset) in Dongguan?

Legal uncertainty

Chinese regulators take these laws seriously. The China Securities and Regulatory Commission banned Tencent-backed Futu, an online broker in Hong Kong, from soliciting new mainland clients, after catching them marketing.

Futu, which is listed on Nasdaq, has also filed for a dual listing in Hong Kong, but its punishment forced it to scotch the IPO the day before its planned listing, on December 31.

Fintechs such as Futu, Up Finance (also in trouble with the CSRC) and others are more likely to operate in gray areas than compliance-focused banks. Although advertizing a brokerage service would obviously be illegal, what about conversing with mainland customers on WeChat about the firm’s house macro views?

Digital solutions seem ideal for solving some of the operational challenges of Hong Kong firms covering customers in Guangdong Province without a costly branch network.

This also appears to give virtual banks or the digital arms of brick-and-mortar banks the lead in serving mainland-based customers. Digital banks by definition make use of alternative data or data fed directly from the borrower’s books to provide the kind of real-time information that can compensate for the lack of traditional credit reports.

The licensing of eight virtual banks in Hong Kong was done with an eye on the GBA. Seven of the eight are backed by mainland banks or big-tech companies. Hong Kong’s population is too small to accommodate all of these new banks, but they have a pathway to scale if they can extend their business opportunity to include customers in Guangdong.

Getting ready: virtual banks

The virtual banks are doing what they can to be ready for when rules change.

Livi Bank, for example, last year partnered with China UnionPay. The virtual bank offers a QR payments solution to allow Hongkongers to pay at retail outlets in the mainland, where traditional credit cards are rarely accepted and a local bank account is required to download a money-transmitting app such as WeChat Pay.

This isn’t exactly “GBA”. Livi or other virtual banks still can’t service mainlanders who aren’t in Hong Kong, nor can it market its services across the border. But it is a step towards “northbound” services, aiding Hong Kong or international demand looking to access mainland China.

Livi hopes to extend the service with UnionPay to all parts of China, not just Guangdong, as well as to Southeast Asia. This shows that it’s a useful service for customers – but there’s nothing GBA about it, i.e., nothing specific to doing business in Guangdong.

Other banks are testing new services in the hopes of turning them into GBA products. DBS has piloted remote account opening for mainlanders who have a business in Hong Kong. Bank of China in the mainland is now allowed to open a bank account for a mainland customer at BoC Hong Kong (but BoCHK can’t open an account in the mainland for a Hongkonger).

The number of accounts opened in these schemes has been low, according to bankers. One reason is that it is illegal for non-mainland banks to do any kind of marketing within mainland China. If they have a mainland license, that entity can do onshore marketing, but only for the local business, not for anything based in Hong Kong or beyond.

It’s also unclear whether SMEs in China are genuinely clamoring for a Hong Kong account; although reports such as Bain’s aver a keen demand, without the ability to market, Hong Kong institutions don’t really know.

Getting ready: alternative data

Fintech credit-rating providers are advancing another means to do GBA business. TransUnion and Nova Credit are consumer credit reporting agencies that are looking to provide the credit profiles on SMEs for Hong Kong banks or non-bank lenders. For now these services can only be sold to Hong Kong entities, but they are investing in the ability to service users in Guangdong.

TransUnion is a US-based fintech, while Nova Credit was founded in Hong Kong in 2017 with cross-border services in mind. It has been honing its artificial-intelligence capabilities, opening an office in Shenzhen and signing a cooperation agreements with Shenzhen Credit and Beijing Data Exchange.

Hong Kong’s government has also built a digital platform for SME alternative data called Commercial Data Interchange. For now it only serves Hong Kong companies but its chief backer, the Hong Kong Monetary Authority, expects it to accept mainland-based users.

Operating in the mainland

In the meantime, financial institutions and fintechs eager to adopt a GBA strategy could set up shop in Shenzhen. The promise of serving either Hongkongers resident in Guangdong, or mainland businesses, would likely require at least one physical branch. This is however very expensive and complicated.

For example, UBS opened a wealth-management business in Qianhai (a part of Shenzhen) six years ago, and only received a license for distributing fund products in 2022. Today it is now able to offer a digital wealth business, but after five years of spending on infrastructure and people. For a bank the size of UBS, such an outlay is possible, but very few institutions can do the same.

Moreover, UBS happens to be in Qianhai, but it could have done the same thing in Shanghai. It’s an onshore business, not a GBA business.

Even picking a location in the GBA requires a lot of research. The point to GBA is connectivity. Guangdong has built plenty of infrastructure to enable Hongkongers to reach deep into the province by car or train, but the limit seems to be a three hour’s journey, beyond which it becomes impractical for Hong Kong-based executives to stay hands-on with the local office.

That means Shenzhen is the favored destination, but Shenzhen consists of nine wards, each competing to attract foreign investment, with their own incentives, taxes, and laws. Some, like Qianhai (itself a town within Nansha ward) are already considered saturated with Hong Kong-affiliated banks, making them unattractive for a smaller bank or virtual bank to open there.

However, the same issues of data and cyber laws apply, and the example of Futu will put the more adventurous business plans on hold.

Help wanted!

Executives at banks and brokers in Hong Kong express frustration that the Hong Kong government isn’t doing more to help them navigate the confusing mainland environment.

For example, the Hong Kong government does not maintain a rep office in Shenzhen to help Hong Kong entities understand what the regulations really mean, provide introductions to important regulators or associations, or analyze how a proposed business model could work.

There are consultants and tax advisors that can help, but no one has a holistic service, and the costs are too high for firms to afford them for long.

The problem is that the Hong Kong government doesn’t have people who know these things. Government-affiliated incubators at Cyberport and the Hong Kong Science and Technology Park try to help but have similar limitations.

“These programs, along with the accounting firms, provide information about incorporation and how to access talent,” says a fintech co-founder. “But we need clarity. Founders need to know what fintechs can do.”

The head of compliance at a local broker says, “The Hong Kong government is not familiar with China. It doesn’t know which office or person is appropriate for what function. They don’t know how to interpret the differences between central-government laws and Guangdong or city laws. They can give us written material but it’s not practical. We need help in the licensing process.”

The Hong Kong government is touting GBA, but the costs and complexity are too onerous, even for relatively large and seasoned firms. “If the cost is high and the risk is high, and the benefit uncertain, the businessman won’t go,” said the compliance executive.

Tech to the rescue?

The core problem for GBA is finding a way to deal with Beijing’s constraints on data, cyber risk, capital flows, and business and product licensing. Everyone in Hong Kong, from bureaucrats to bankers, is eager to see the GBA become a reality. China has endorsed the flow of goods, people, money and information between the mainland and Hong Kong – but not the free flow.

Technology could solve some of these problems. Federated learning, for example, is a machine-learning technique that enables an algorithm to work with different pots of data that are housed in different places. The algo could in theory deliver a credit assessment without a bank moving or seeing the underlying data.

TransUnion, for example, has partnered with Openhive, a federated learning platform, to launch Hong Kong’s first federated learning data network. For now this is working across sectors within the city but it could be rolled out for GBA purposes. Tencent has also been active with federated AI.

A digital-banking executive at a traditional lender says she pitched a federated solution in house. The bank tabled the idea with the HKMA but the project has gone quiet. She doesn’t know why, but notes that these are ultimately problems with regulation, not with technology.

Blockchain is another possible mechanism to enable Beijing to comfortably loosen the reins. China has been building lots of (non-crypto) blockchain infrastructure, and there are companies like Red Date trying to bridge mainland and international blockchain businesses.

Hong Kong has been experimenting with cross-border central-bank digital currencies for payments. In theory these could be used to regulate the flow of money or data within parameters set by the mainland and Hong Kong authorities.

However, blockchain or CBDC solutions for payments don’t address the pain points in GBA business, which are account opening and extending credit.

Wealth and other Connects

GBA is not completely barren. The most established GBA business is through the Hong Kong Stock Exchanges’ various “Connect” programs with its counterparties in Shanghai and Shenzhen. This began with Stock Connect in 2014, enabling the trading of one side’s securities on the other side’s exchange.

This was followed by Bond Connect and a Mutual Recognition of Funds (MRF) scheme, which in turn was followed by Wealth Management Connect. A Swaps Connect and Insurance Connect are on the drawing board.

Wealth Management Connect is the first real opportunity for consumer banks to offer products to customers across the border. Unlike insurance, which must be sold to mainlanders who are physically present in Hong Kong, wealth services can now be provided to mainland customers, within a closed loop of cash monitored by the regulators. That service can be fully digital, or it can be offered within the branches of a partner mainland bank. But there is no need for a mainland person to travel to Hong Kong to avail herself of a Hong Kong-domiciled investment product.

Wealth Connect’s introduction hasn’t been smooth. Covid-related restrictions on travel or face-to-face meetings have been a big barrier, and fortunately one that is temporary. Other more durable challenges remain. The risk assessment on products is overly conservative and investment quotas are low. The kind of products that would seem most attractive to mainlanders seeking new types of assets aren’t readily available.

Although this can and probably will change, the example of the MRF is sobering: launched in 2015, its overly conservative regulations have yet to be liberalized.

What the other side wants

As of the end of 2021, the 36 funds sold into China claimed a net inflow of $2.1 billion (or an average of $60 million per fund), while the 47 China funds sold to Hongkongers have netted a paltry $148 million (about $3 million each).

The MRF, in other words, which debuted with the sort of hype that we now hear with Wealth Connect, has been a big flop.

It’s not just because of restrictive regulation. Although “GBA” hums constantly in Hong Kong discourse, it’s not clear that anyone on the China side gets very excited about it. It’s not like the nine cities of Guangdong Province are eager to collaborate – on anything. Even wards within Shenzhen regard one another as competitors. Why should anyone regard Hong Kong as a priority?

For example, one reason for “southbound” China funds in the MRF scheme don’t sell is because mainland fund managers aren’t geared to sell to an international clientele. Their fund prospectuses and term sheets are usually all in Mandarin, rather than fitted to a Cantonese-speaking (let alone English) market. And with sales so pitiful, Chinese firms lack an incentive to take Hong Kong seriously.

In other words, Hong Kong is more likely to realize the benefits of GBA if there are mainland banks and officials that decide it’s valuable to get access to the Hong Kong market. Then they might be more amenable to handing out licenses and enter data-sharing deals with Hong Kong institutions. The Hong Kong Stock Exchange is obviously attractive to mainland companies, but Hong Kong’s banking services?

Why it still makes sense

This is not to say the GBA is a bad idea or should be ignored. China has a longstanding habit of announcing visionary ideas that take years to make their way through the bureaucratic apparatus. Bold reforms begin cautiously, and trial and error is the only way to get things done.

“The GBA should be a big moment if it means providing mainlanders access to financial services,” says a fintech CEO. “But there’s no imminent opportunity for fintechs to go after. There’s no clarity around providing credit or bank accounts to mainland customers that don’t already have a locally incorporated business.”

From Xi Jinping down to Hong Kong officials, it seems everyone important is eager to promote the idea of a GBA. The HKMA has a 2025 blueprint to digitize the city’s banks. That’s expensive, so the GBA is the carrot – the growth that justifies the costs of digital transformation. Fintechs and the government are building some infrastructure, like CDI. But the important enabling laws are missing.

The Covid pandemic has been a huge distraction. Beijing authorities have been focused on a tech crackdown while ratcheting up data-protection laws – not a conducive environment for fintechs or digital banks. Both the pandemic and the crackdown are abating. The industry is desperate for growth and Hong Kong needs to reestablish its credentials as a world-beating financial center.

The GBA is a good solution. It’s time for authorities on both sides of the border to stop talking about vision and get whatever is necessary done to issue licenses, approve data-sharing deals, and outline next steps and a timetable.

The GBA Czar

The Hong Kong government should appoint a “GBA Czar” with the chief executive’s authority to coordinate across the entire bureaucracy. The GBA Czar should also learn the mainland side, beginning in Shenzhen and at the Guangdong provincial level. Hong Kong’s banks and fintechs will appreciate any help with jumpstarting the necessary relationships.

The Czar should have a legal arm to provide a view on China’s overlapping laws. The office could also consider developing a platform similar to APIX in Singapore, to help matchmaking among mainland and Hong Kong fintechs and banks looking to do cross-border business. The goal of such initiatives is to mitigate the high costs and risks of GBA-related business.

These services would not replace the work done by accounting firms, incubation programs, or industry associations. The fact is that these cross-border relationships are complex and murky. The GBA Czar would instead catalyze their existing efforts.

One way it would do so is by being the visible go-to office in Hong Kong for counterparts in China – not the high-level officials that are the remit of the chief executive, but the manifold layers all the way down to Shenzhen ward bosses, bank branch heads, real-estate developers, business associations, and tech CEOs.

Hong Kong officialdom has been evangelizing the GBA to its own city and to the international community for years. But the most important pitch should be made across the border.

DigFin direct!

The bank-v.-fintech battle for payments moves into B2B

How far outside of China can China’s fintech giants go?

Changing banks, and money | Hubert Knapp | VOX Ep. 82

Kyobo’s digital life insurer peps up after a slow decade